Did you know that some mutual funds consistently outperform the market, yielding substantial returns for those in the know? Many investors miss out on these hidden gems, making uninformed choices instead.

With global financial markets more volatile than ever, understanding mutual fund options and their potential is crucial to safeguarding and expanding your wealth in 2024. Ignorance isn’t bliss when it comes to your financial future.

Contrary to popular belief, not all mutual funds require a massive initial investment. Many top-performing funds are accessible to the average investor with starting points as low as $500. But that’s not even the wildest part…

Some mutual funds have performed better in crises than stable times, proving lucrative despite market downturns. This defies common investment logic, but those who know how to leverage these options reap substantial rewards. But that’s not even the wildest part…

Investors are turning their heads to some unconventional strategies within mutual funds that have begun to yield surprising profits. Some methods have shocked even seasoned financial advisors. What happens next shocked even the experts…

Low-cost index funds are an overlooked powerhouse, offering robust returns at minimal costs. A majority of actively managed funds fail to beat these cost-effective alternatives. What you read next might change how you see index funds forever.

Many investors overlook index funds because they believe higher fees translate into higher returns. Yet, statistically, keeping costs low improves your overall profit, especially with long-term investments. But that's just scratching the surface...

Even during economic downturns, certain index funds have demonstrated an impressive ability to recover faster than individual stocks, providing a safer bet during turmoil. There’s one more twist to this strategy...

Some investors have honed in on specific index funds that focus on sustainable and ethical companies, tapping into a growing trend of socially responsible investment with substantial profit margins. But that's not all there is...

Hidden fees can slowly drain your returns, leaving you with far less than anticipated. Understanding the true cost is essential for any savvy investor. Curiosity will lead you to discover how these fees are masked.

Even funds advertised as “no-load” might integrate other expenses, like management fees or contingent deferred charges, that catch investors off-guard. But it gets more intriguing...

Some funds skillfully use marketing tactics to gloss over these expenses, which can eat into your profits if not carefully considered. The reality is startling...

However, investors can easily circumvent these pitfalls by delving into fund specifics, choosing those that maximize transparency and cost-efficiency. But wait until you learn what's keeping fees up in some cases...

Contrary to the passive investment strategy, actively managed funds offer a dynamic approach, led by experienced fund managers. These funds are often shrouded in misconceptions.

Skilled managers can sometimes exploit short-term market inefficiencies, bringing in higher returns than a typical buy-and-hold strategy. But this is not the most surprising aspect...

Some actively managed funds succeed by focusing on niche industries, where specialized knowledge yields superior insight into market trends. And it doesn't stop there...

Understanding the unique strategies behind certain successful funds can open investors to higher returns potential, although this often comes with increased risk. But there's more to uncover...

Timing the market versus time in the market — the debate rages on, but its implications for mutual funds are significant. Insight here could transform your strategy.

Investors that attempt to time their entries and exits can often miss key growth periods, drastically impacting long-term returns. But there's deeper insight...

Contrarily, those practicing patience and allowing compounding to work over a long horizon regularly outperform. The key lies in understanding the market cycles...

Some experts argue a hybrid approach can leverage both strategies effectively, hedging against downturns while capitalizing on recoveries. This may upend traditional thinking...

ESG funds have emerged as a formidable presence, aligning investment with values. Their exponential growth reveals a shift in investor priorities.

These funds focus on companies minimizing environmental impact and upholding social governance, appealing to a new generation of conscientious investors. There's more to know...

Historically, ESG funds were dismissed as gimmicky, but recent performance shows they can offer competitive returns, sometimes exceeding traditional portfolios. But look closer...

The increasing demand is not only driven by ethics but by recognition of sustainability as a factor in long-term profitability. The next part of the trend might surprise you...

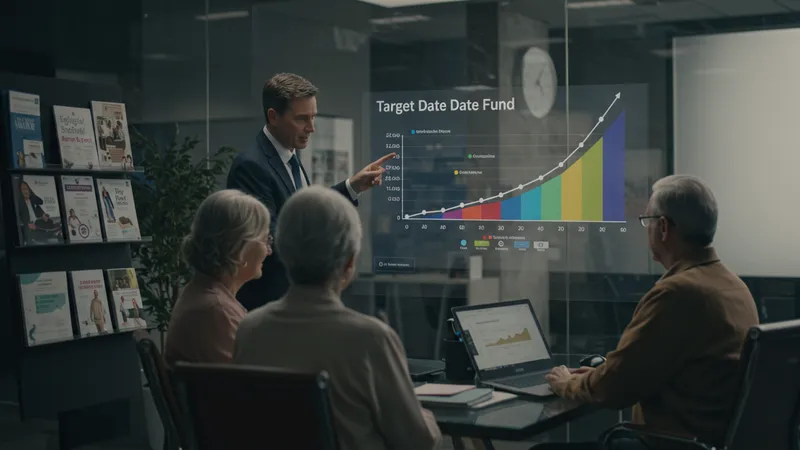

Investors seeking hands-off diversification flock towards target date funds, tailored to adjust their asset allocation as retirement approaches. This trend holds surprises.

These funds automatically shift from high-risk, high-return equities to more stable bonds, adjusting risk as the investor ages, providing peace of mind and security. But wait, there's more...

However, the performance of target date funds isn't uniform, with some outperforming due to strategic management adjustments not found in their simpler counterparts. But that’s not the full story...

Investigating individual fund strategies offers a deeper insight and can reveal which funds better align with your personal retirement timeline. But that's not where it ends...

Sector funds focus on specific economic segments, offering amplified exposure to industry movements. This can be a double-edged sword, but it has potential.

By investing in a booming sector, like technology or healthcare, an investor may capitalize on targeted growth, leading to impressive returns. But there's catch...

Sector-specific funds come with increased volatility, as underperformance in a chosen industry can adversely impact holdings. But that's not all...

The savvy investor balances sector bets with broader diversification, optimizing for gains while minimizing downsides. Yet the complexities run deeper...

Dividend-focused funds serve as a nifty investment avenue, providing regular income and potential for capital appreciation, tantalizing both conservative and aggressive investors.

These funds invest in companies that consistently pay high dividends, which can buffer against volatility, stabilizing portfolios during downturns. Yet, there is more...

Beyond the safe-haven perception, certain funds have also captured significant capital growth by reinvesting dividends, a compounding strategy that enhances returns. But that's only the beginning...

Better yet, navigating the list of dividend funds and selecting those with an attractive dividend yield combined with growth prospects can be rewarding. Yet the insight runs further...

Global funds unlock international markets, offering exposure and diversification beyond domestically focused investments, crucial in today's interconnected world.

Investing globally mitigates domestic risks and can capitalize on emerging market growth, driving robust returns. But, there's more at play...

The multifaceted nature of global funds requires an astute understanding of geopolitical and currency risks, balancing these against potential rewards. However, you might not know this...

Selecting regions with favorable economic climates or burgeoning middle classes can significantly amplify returns, but there are considerations you wouldn't expect...

Small-cap funds invest in burgeoning enterprises with room for growth, often exceeding returns of larger firms but with elevated risks attached.

These funds have historically outshined large-caps in bull markets, offering a window of opportunity during economic recoveries. Yet, surprises abound...

The intrinsic risk of small-cap funds necessitates a keen eye for resilient companies capable of weathering market challenges. But the narrative continues...

Balancing small-cap allocations within a diversified portfolio can enhance overall performance without overwhelming risk exposure. There's more to navigate though...

Growth funds target companies expected to grow at an above-average rate compared to their industry peers, a haven for those pursuit-rich returns.

Fueled by innovation and expansion strategies, growth funds often entail higher volatility with enticing potential gains offsetting the possibility of loss. Yet, there's another angle...

These funds thrive on economic upswings but can retract swiftly in downturns, requiring savvy timing or long-term holding. The most surprising factor lurks...

A strategy combining growth with elements from value investing can mitigate extremes while capturing uptrends, refining an all-encompassing investment approach. But the story dives deeper...

Value funds zero in on undervalued stocks, providing a contrarian approach poised to capitalize on market corrections and overlooked growth.

Rooting out intrinsic value, these funds can outpace during recoveries, offering a safer concern amid economic uncertainty. Yet underlying mysteries await...

However, successfully navigating value investments requires determining genuine undervaluation from distressed assets, a challenge bearing high stakes. A twist still surfaces...

Balancing value with growth options equips investors with comprehensive strategies suited to diverse market scenarios, offering a dual-edged benefit. The strategy deepens here...

Bond funds epitomize safety, providing predictable income and portfolio stability amid economic volatility, enticing more conservative investors.

Achieving capital preservation, bond funds can hedge against riskier equity exposures, grounding portfolios during market swings. Yet counterintuitive insights emerge...

Higher yields in certain bond sectors extend an enticing proposition without embracing elevated equity risks. But shockingly, there's more to manage...

Navigating between government and corporate bonds adds complexity, demanded comprehension of interest rates and credit quality impacting fund choice. This opens another discussion...

Uncovering an adept mutual fund strategy opens a gateway to steady financial growth, but the essence lies in comprehension and informed diversifications.

The path from novice to seasoned investor in mutual funds isn’t linear, providing ample learning opportunities through exploration and adjustment. Yet, there’s more to explore...

Embracing various funds tailored to diverse economic climates offers a unique mastery over market intricacies previously inconceivable. The finale channels another reflection...

The journey toward mutual fund enlightenment encourages vigilance and discovery, birthing empowered investors equipped to craft robust, dynamic portfolios. Embark further on your financial odyssey...

While diving deep into mutual fund options promises transformative growth and security, practicing due diligence and continuous learning remains pivotal. Every page in this venture illuminated nuances previously obscured.

Sharing knowledge empowers not only you but also those connected within your circles, perpetuating a cycle of informed maturity. Bookmark this guide, and revisit as you navigate the ebbs and flows of financial life. Until next time, evolve strategically, share freely, and invest like never before.